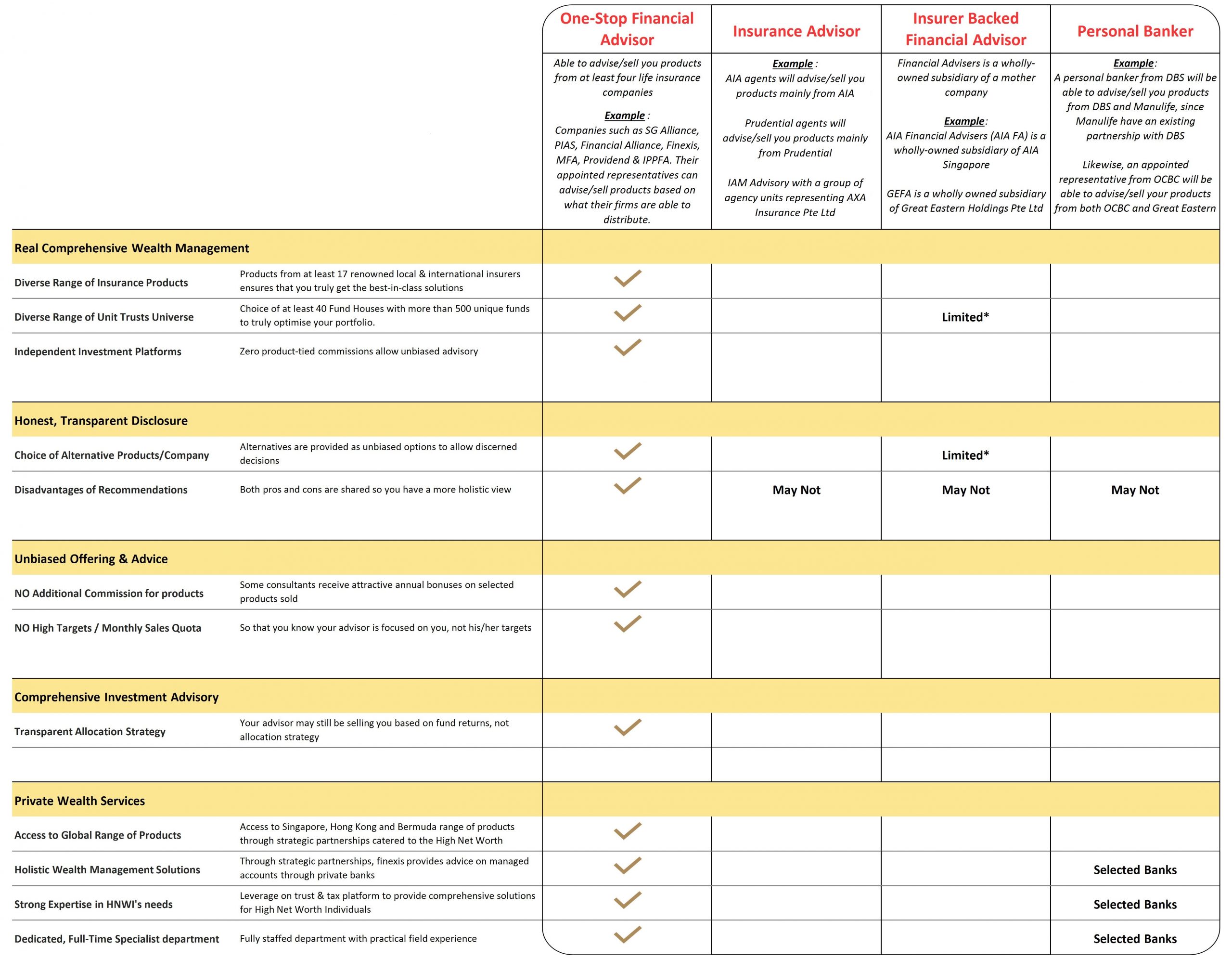

The One-Stop Financial Approach

“A little difference goes a long way”. What if there’s a big difference here? There’s nothing we want to leave to chance, and you shouldn’t too. That’s why we’re offering so much more than just a few differentiated offerings. Compared to the other providers in the industry, the table below gives an overview of how much impact we can establish for you.

Man Behind One-Stop Financial

Since the very first day, I have always had a strong passion for the professional field of wealth management. There are lots of financial schemes, insurance and investment that encircle us. Despite the array of financial solutions (insurance, investment, etc) made available to us today, we are often unaware of the most appropriate solutions that will best address our financial goals. It is crucial to understand financial planning to avoid regrets. This contributed to why I joined financial services sector after graduation with a Bachelor of Business (Economics and Finance).

I love this challenge and find it incredibly interesting. I have always enjoyed learning business art, understanding it better as it can be applied everywhere in our lives. Singapore is well-known as a financial hub, so joining financial services has been an easy career choice.

Being in the financial services allows me to better understand the current compulsory and voluntary schemes and to maximize the financial resources available.

In LIFE, we plan for the “IF” (the unexpected events). We may fail to achieve our goals if we fail to plan.

A financial planning process should never reduce you from drinking water and eating bread simply to save money and protect yourself. It is intended to ensure that you can protect your lifestyle when unexpected events take away your earning power and are ready for known events such as retirement.

Rely on my competence to help you create a robust portfolio in accordance with your risk profile and risk appetite. Your portfolio will retain transparency and most importantly flexibility to be adjusted according to market conditions.

Financial management is a serious business, but I will always try to make it interesting and enjoyable to help you achieve your dreams! I value the relationship with my clients and it’s always the highest priority in my career to maintain strong relationships with you.

There is always a cost. Just who pays for it

One-Stop Financial

One of the main reasons why this website was established primarily is to address financial misconceptions and share what I know about finance.

Financial growth revolves around delayed gratification. Apply this to your financial life (which I will teach you how to do), and I promise you a life that is far more fulfilling than if you have not tried it.

Knowledge is power and power is essentially wealth. The greatest discovery of all time is that a person can change his/her future by merely changing his/her attitude.

The plain vanilla advisory process together with me is not all, you will also be taken on a journey where you will be gain access to talks and activities which will teach you to maintain a desirable lifestyle without compromising your financial health

As an Investment Broker

I started my financial career in an investment brokerage firm, Phillip Securities. I specialize in asset allocation and diversification for all risk profiles.

One thing that I can promise you, even in this market is that I never ask my investors to judge me on my wins. I asked them to judge me on my losses because I have so few. And in the case of investing for wealth accumulation, I would be happy to share how I did all this while convincing you to let me manage your money.

My goal is to teach you to be forward-looking and to make better choices for your future. I can’t stress enough the importance of long term planning. Commitment brings fortune.

If you can and are willing to commit, then you’re going to come out on top

As an Insurance Broker

As an insurance specialist, I specialize in retirement lifetime income accumulation plans. The cost of living increases as Singaporean lifespan grows. This is where retirement wealth accumulation comes into play.

I believe that you must not have any mistakes in your retirement years as you had worked hard for your whole life and it’s time for you to enjoy the rest of your life with your loved ones. There is no way that you are going to restart your life when you are in your retirement age. Having the right retirement planning is, therefore, the utmost important plan you should get it done.

With the right retirement wealth accumulation plans, you will enjoy and maintain your current lifestyle during retirement without any money problems such managing with the rising healthcare cost, especially with the hospital insurance premiums, and the costly living expenses in Singapore.

Start building for your retirement plan early means getting to enjoy more compounded returns and putting money to work for you!

-scaled.jpg)

-scaled.jpg)