What are REITs?

A Thorough Comparison & Analysis

Singapore Real Estate Investment Trusts (also frequently referred to as S-REITs) are listed undertakings that pool the assets of investors to invest, own and manage the property.

The properties are then rented out in exchange for rent to tenants. Investors investing in REITs are REITs’ co-owners. They have the right to earn rental revenue from the consistently distributed estate assets.

Investors will also profit from the capital gain as the valuation of the estate increases. While REITs may not be a popular word for many non-investors, Singaporeans are no stranger to properties owned or managed by these REITs.

REITs in 90 Seconds

Property can be a reliable source of income, even if you don’t physically own any real estate.

Watch this to find out what real estate investment trusts (REITs) are and how investing in them may give you another source of income

Credits: Temasek

Table of Contents

Introduction to REITs

How to buy REITs?

REITs are traded as ordinary stocks in the stock exchange. You’ll need 2 accounts before you can invest in local REITs:

- SGX CDP account

- Stock Brokerage account

If you are a completely new investor, you can go straight to a local brokerage firm directly to apply for both accounts together. Depending on your broker, the turnaround time will take less than 7 working days.

If you’ve invested in the stock market, you’re likely to have both accounts already. All you need is to understand your REITs code and buy it through your online brokerage platform or call your broker.

How to spot an ideal REITs?

Most investors assume that all REITs are equally safe and the only difference is the dividend payouts they receive. The reality is, investors in REITs face the same hazards as any other investor in stocks. Therefore, your due diligence needs to be done and you need to explore the REITs you are interested in.

Despite having a distinct structure to the traditional framework of real estate investment, REITs are an investment that relies on the capacity of the underlying real estate to produce revenue. As with all investment in real estate, it is essential to evaluate the REITs.

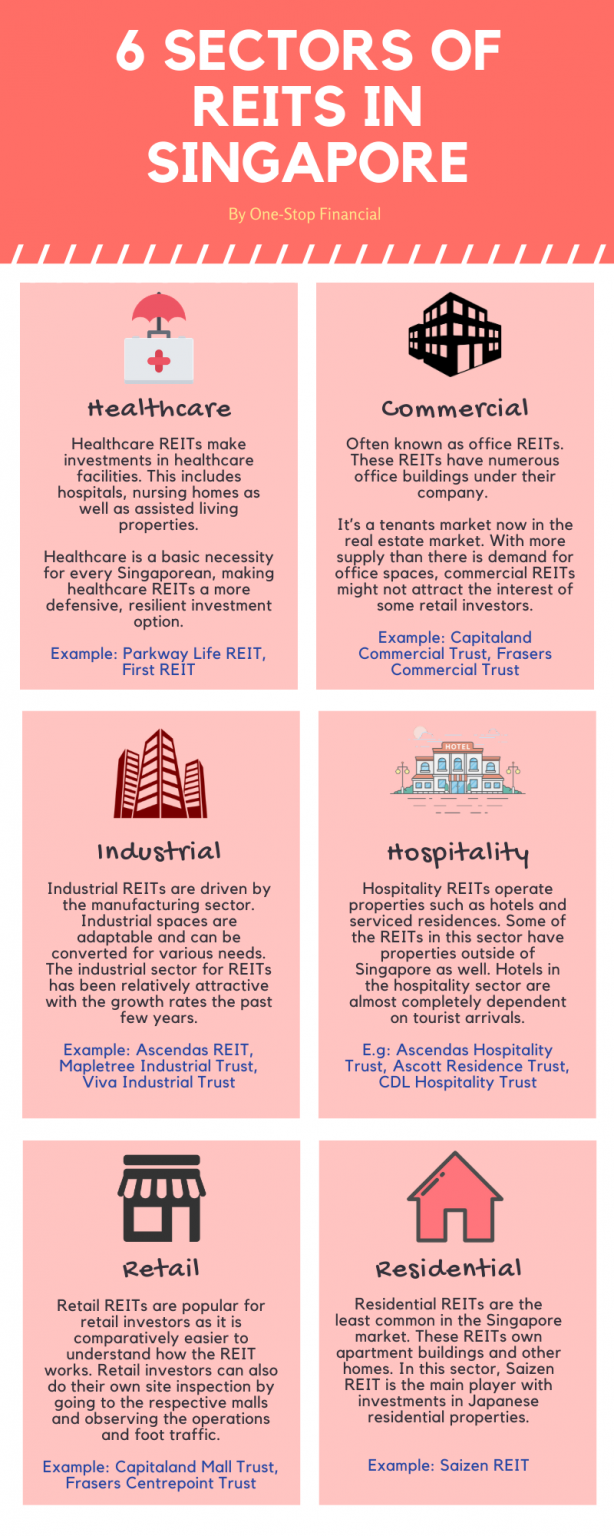

REITs worth investing in should have a sustainable investment perspective in sub-sectors. This perspective can refer to any macro trend in the sector and financial developments from interest rate and regulatory trends.

Another macro trend is the increasing emergence of data science as corporations start harvesting information for data analytics implementation. This tends to raise data centre demand. Therefore, in terms of investment perspective, we can look to data storage REITs as a better option to office REITs.

REITs’ nature lies between a stock’s behaviour and a bond.

REITs own a property portfolio and receive rental revenue from tenants of the properties. After accounting for expenses, this rental income is then allocated to shareholders. This provides REITs, like the quarterly coupon payments that bondholders receive, a bond-like feature of quarterly dividend payments to shareholders.

On the other side, REITs also function similar to a stock in which speculation, better valuation and forward perspective can push its share price greater to yield capital gains to shareholders. Any catalyst can drive these capital gains.

Good REITs investments should continue to be growing its net income on a year-on-year basis. Growth from good REITs can come from either:

- Positive rental reversion and increasing occupancy.

- Acquisition of new properties or investing in undeveloped properties.

Cap rate, or rate of capitalization, is the rate of return on an investment property based on the property’s anticipated revenue while dividend yield measures the revenue of the REITs against market capitalization. It is much better to use the cap rate as the REITs lease generating capacity indicator. A high cap rate can indicate the potential of the management or property to order greater rental revenue.

This can offer you a better understanding of whether the REITs in focus is actually producing excellent rental revenue or simply using shenanigans accounting to make you believe it’s a good investment.

How do you pick REITs?

The key is to uncover one that is well managed and capable of ensuring a continuous revenue stream. Don’t just go for those with larger reported returns, but take the moment to read the prospectus for the REITs and see if it suits your risk appetite and how long you plan to stay invested.

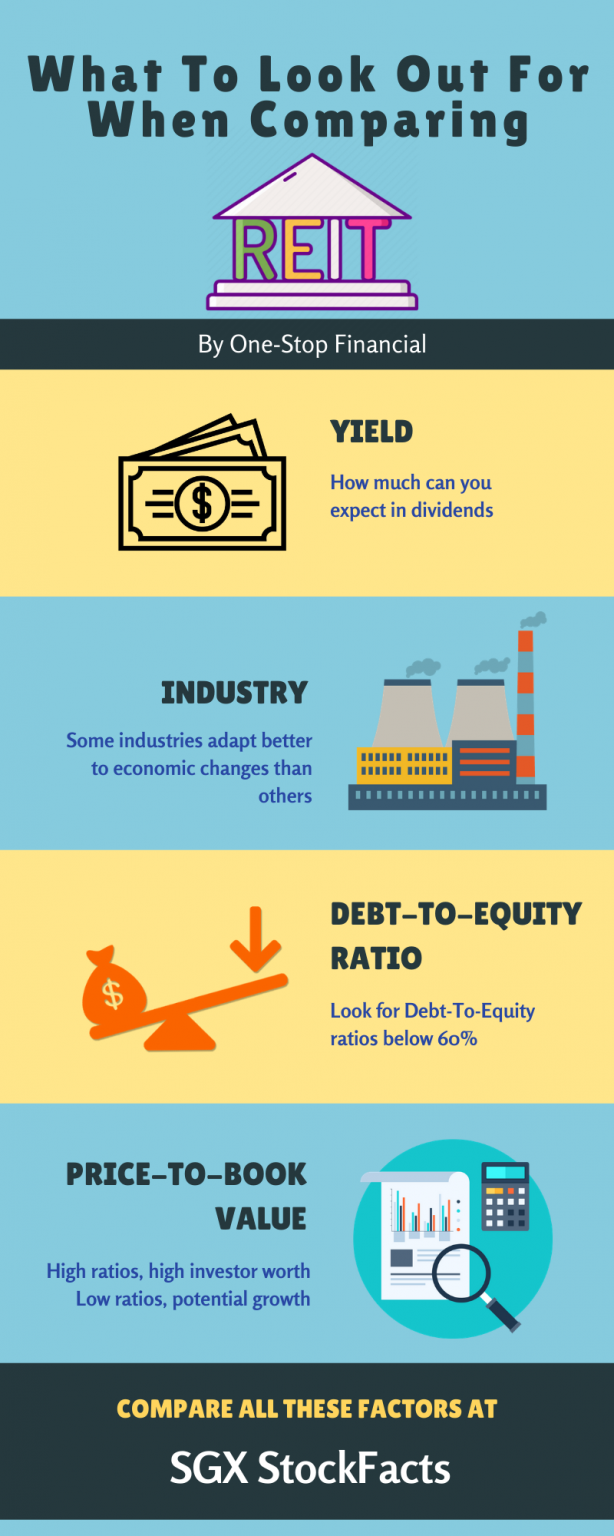

SGX Stock Screener (Select Sector > Real Estate) is a useful place to start. If you want to see anything other than the default stats, you can customise your display and select a different set of data points. This is a good way to see, at a glance, which REITs have the highest yield, which gives you an idea of how much in dividends you can hope to get.

But there’s no point buying a REITs that goes down in flames in the near future, so you also need to check for indications of its stability, such as the historical share price and debt-to-equity ratio. Fortunately, big-name REITs are generally fairly stable and it’s unusual to find one that has borrowed beyond its means.

What might impact your decision more is the nature of the REIT’s property portfolio – whether it specialises in industrial, business, healthcare, retail properties, and which countries it plays in. Some REITs might be more resilient to changes in the economy and some might be less so. The current industrial property market, for example, might see a drop in rental prices in order to retain as many tenants as they can in a slower economy. This will probably lead to a drop in income, and dividends may not be paid out if the REITs reports an operating loss.

REITs VS Business Trust

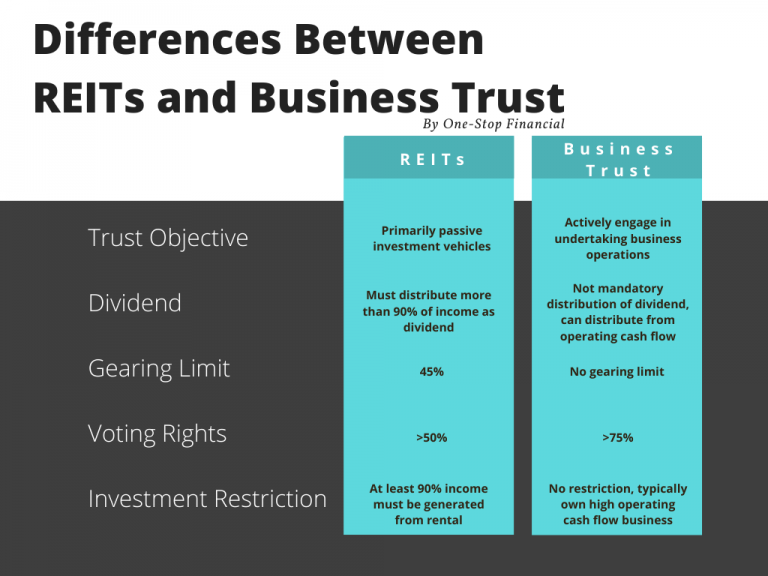

Lastly, many investors are always confused about Real Estate Investment Trust (REITs) and Business Trust (BT). Although both of them sound similar, the nature of both instruments is quite different. Due to these differences, both trusts behave differently in the market.

As REITs investors, you should know these differences as they will affect the dividends payout you are entitled to and may expose you to the different level of risks:

The objective of both trusts is very different. REITs look for passive income while Business Trust actively engages in undertaking business operations. If you are an investor looking for passive income, you should invest in REITs rather than Business Trust.

The regulation for dividend distribution is not the same for REITs and Business Trust. REITs is mandatory to distribute at least 90% of disposable income to the unitholders while Business Trust is not mandatory to distribute dividend. However, Business Trust can distribute dividend from operating cash flow.

This means that even though the net profit of Business Trust is less than zero, Business Trust still can distribute dividend if the operating cash flow is positive. Because of this reason, Business Trust tends to own businesses that have high operating cash flow.

REITs maximum gearing limit is only 35% for non-rated REITs and 60% for rated REITs. But for Business Trust, there is no gearing limit. Both have pro and con for this gearing limit.

Gearing limit for REITs is good for investors who have a low-risk appetite while Business Trust can increase their leverage without limit is suitable for investors who have a high-risk appetite.

REITs require at least 50% of voting right to pass through certain proposals while Business Trust requires at least 75% of voting right.

This means that the controlling interest for Business Trust is only required to hold more than 25% of the company. Because of this reason, Business Trust tends to have a higher free float and can raise more fund from issuing units to public investors.

At least 90% of income for REITs must be generated from the rental income while there is no restriction for Business Trust.

This can be bad if the property market is in a downturn, the income for REITs may be affected, and thus there might be a lower dividend for the unitholders.

So, which one should you invest? REITs or Business Trust? That depends on your investing objective.

If you are looking for passive income, REITs may be a better choice. If you are looking for higher return, Business Trust tends to give higher return but come with higher volatility and high risk.

How to screen and filter for REITs fund?

If you’re new to invest, SGX has a REITs-screening platform ready to get you moving on shortlisting stocks that are worth looking at based on your needs. Within your shortlist, you can readily use this platform to compare distinct kinds of REITs you are looking at, especially finding details such as Asset Class, Geography, Benchmark and Fund Manager’s Information.

Best of all, to use the platform, you don’t even need to sign up. Just go over to SGX Stock Screener (Select Sector > Real Estate).

Which is the best-suited REITs for me?

While our intention to invest is to generate profits, we also need to be intelligent in selecting the correct strategies that make sense to you. Here are some variables to consider before deciding on the investment strategy that works best for you.

1) Know how to identify and analyze – In order to be profitable in investment, you need to know how to identify and analyze REITs fund.

2) Diversification – to manage risk, you should look into what the REITs fund portfolio are investing. You should go for the REITs fund according to your desired risk-return profile.

3) Know your Risk Tolerance – before you start buying REITs. Different types of REITs have different risk. Investing in oversea funds tends to be much riskier and usually most impacted by currency exchange risk.

4) Personal Interest – may also impact your investment strategies. For instance, if you’re someone who likes to read news linked to commercial REITs and enjoy checking out the recent news that can alter our world, then you may be naturally inclined to invest in REITs industry businesses like CapitaLand Commercial Trust and Frasers Commercial Trust.